Knowing Your Credit Score: Buy House and Property Intelligently

Knowing Your Credit Score

Your credit score plays a heavy role on the interest rate you will receive for your new mortgage loan for investment properties from your lender. The first major factor is how many late payments (30 days or more, 60 days or more is even worse) are on your credit report. Derogatory payments of less than 30 days do not show up.

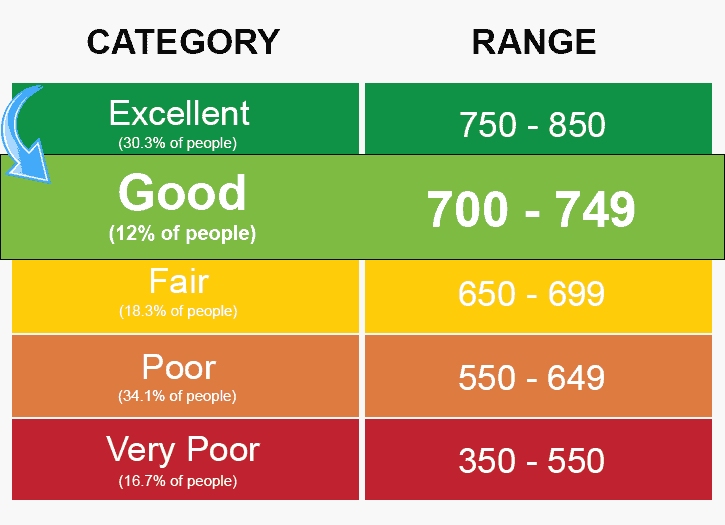

The second major factor is your combined credit rating from all three credit agencies. If your credit score is 650 or above you will most likely be approved for a conforming loan with an interest rate at a lower rate. If your credit score is below 650 you will probably be approved for a nonconforming loan with an interest rate at a higher rate. Remember the lower the credit rating the higher your interest rate will be. Some lenders accept credit ratings down into the lower 500’s.

A third major factor is if you claimed bankruptcy in the last 2 years. Most lenders and financial institutions require that your bankruptcy has been discharged for at least one year.

Remember, know your credit score before you apply for an investment property mortgage loan. Knowing this will help you know how much and at what rate you will qualify for. If you have a credit score above 650 I would recommend applying directly through a bank than a mortgage broker so you will not get charged brokerage fees and a bank will most likely give you the best rate.

If you have not viewed your credit report within the last year you can get a free credit report (they will charge extra for your credit score) from the U.S Government website at Federal Trade Commission.