Living In Illinois

Local Editor(s)

Table of Contents:

- The Complete Guide to Cost of Living and Lifestyle

- Key Takeaways

- I. Methodology: How We Analyzed the Cost of Living

- II. Detailed Community Analysis: Illinois Living Costs

- 1. Illinois Housing Costs: Navigating a Diverse Market

- 2. Illinois Tax Structure: A High-Burden State

- 3. Daily Living Expenses in Illinois

- 4. Family Life in Illinois: Education and Community

- 5. Illinois Transportation: Urban vs. Rural Options

- 6. Illinois Job Market and Income Potential

- 7. Cost of Living Comparison: Illinois vs. Other States

- 8. Illinois Lifestyle: The Ultimate Trade-Off

- 9. Best Places to Live in Illinois for Different Needs

- Frequently Asked Questions About Living in Illinois

The Complete Guide to Cost of Living and Lifestyle

Illinois offers a unique blend of urban sophistication and Midwestern affordability, with Chicago’s world-class amenities balanced against the state’s diverse economic landscape. The Prairie State attracts everyone from young professionals and families to retirees seeking its cultural richness and career opportunities. However, Illinois residents face challenges including high taxes and variable economic conditions. This comprehensive guide covers housing prices, taxes, daily expenses, and lifestyle factors to help you decide if Illinois is the best choice for your next home.

Key Takeaways

- Affordable Housing Outside Chicago: Illinois’ housing market offers significant value outside the Chicago metro area, with median home prices well below national averages in many communities. However, costs vary dramatically between urban centers and rural towns.

- High Tax Burden: Illinois has one of the highest overall tax burdens in the nation, with high property taxes, income taxes, and sales taxes that impact residents’ budgets significantly.

- Economic Diversity: The state offers diverse employment opportunities across multiple sectors, including finance, manufacturing, healthcare, and technology, though economic stability varies by region.

- Lifestyle Trade-Off: The benefits of cultural amenities, educational institutions, and career opportunities are balanced against high costs, traffic congestion in urban areas, and significant weather challenges and regular fluctuations.

- Community is Key: Strong neighborhood communities enhance quality of life for those who embrace what Illinois has to offer, from Chicago’s diverse neighborhoods to small-town Midwestern values.

I. Methodology: How We Analyzed the Cost of Living

Our analysis is based on a multi-factor review of key elements that impact residents’ financial well-being and daily life. We compiled data from several reputable sources from 2025, including the U.S. Census Bureau, Bureau of Labor Statistics, Zillow housing market reports, the Tax Foundation, and local Illinois state agencies.

Our evaluation criteria are weighted as follows:

- Housing & Affordability (30%): The largest budget item. We analyze median home prices, rental costs, and property taxes, using ratios like home-price-to-income to gauge true accessibility for those looking to buy.

- Daily Living Expenses (25%): This metric evaluates the costs that define a daily budget, including groceries, utilities, transportation, and healthcare, benchmarked against national averages.

- Tax Burden (20%): A crucial component of affordability. We assess the impact of state income, sales, and property taxes on overall financial planning for both workers and retirees.

- Income & Economic Context (15%): Affordability is relative to earnings. We examine median household incomes and economic stability to provide context for the cost data.

- Lifestyle Value (10%): We evaluate the intangible ROI of living in Illinois, considering access to culture, education, and community amenities that offset the monetary costs.

Our Methodologies to create HOMEiA Score Ratings for Each Group of Content

HOMEiA uses a consistent, data-driven methodology to evaluate U.S. states for livability, affordability, and long-term value. Our analysis centers on key factors such as Housing and Affordability, Cost of Daily Living, Access and Infrastructure, Community Strength, Safety and Quality of Life, Economic Resilience and Job Market…

II. Detailed Community Analysis: Illinois Living Costs

Illinois’ housing market presents a tale of two states: the expensive Chicago metro area and affordable communities throughout the rest of the state. Expenditures vary dramatically between urban centers and rural towns.

A. Major Illinois Cities Housing Costs

City | Median Home Price | Avg. Rent (2-Bedroom) | Home Price to Income Ratio | Income to Rent Ratio | Safety Rating |

|---|---|---|---|---|---|

| Peoria | $135,000 | $975 | 2.4:1 | 29.8x | 65/100 |

| Rockford | $145,000 | $1,075 | 2.5:1 | 32.1x | 62/100 |

| Springfield | $155,000 | $1,025 | 2.6:1 | 31.4x | 70/100 |

| Champaign | $195,000 | $1,250 | 3.1:1 | 34.2x | 75/100 |

| Aurora | $250,000 | $1,550 | 3.2:1 | 36.8x | 68/100 |

| Chicago | $315,000 | $2,000 | 4.2:1 | 38.2x | 72/100 |

| Naperville | $450,000 | $2,100 | 3.8:1 | 41.5x | 85/100 |

B. Illinois Housing Strategies and Financial Options: Financing a home in Illinois is straightforward, with widely accepted FHA, VA, and conventional loans available. However, first-time homebuyers should pay special attention to property taxes, which can significantly impact monthly payments. A thorough inspection is critical, especially for older homes in Chicago’s historic neighborhoods. For suburban properties, the quality of public schools in a district often correlates with higher property values and tax rates.

Moving to Illinois: The Complete Relocation Guide & Checklist

Illinois’ cost of living is 10% above the U.S. average, driven by housing, though utilities are cheaper. The state offers a diverse climate, strong economy across key industries, rich cultural variety from Chicago to small towns, and excellent transportation networks connecting its urban and rural communities statewide.

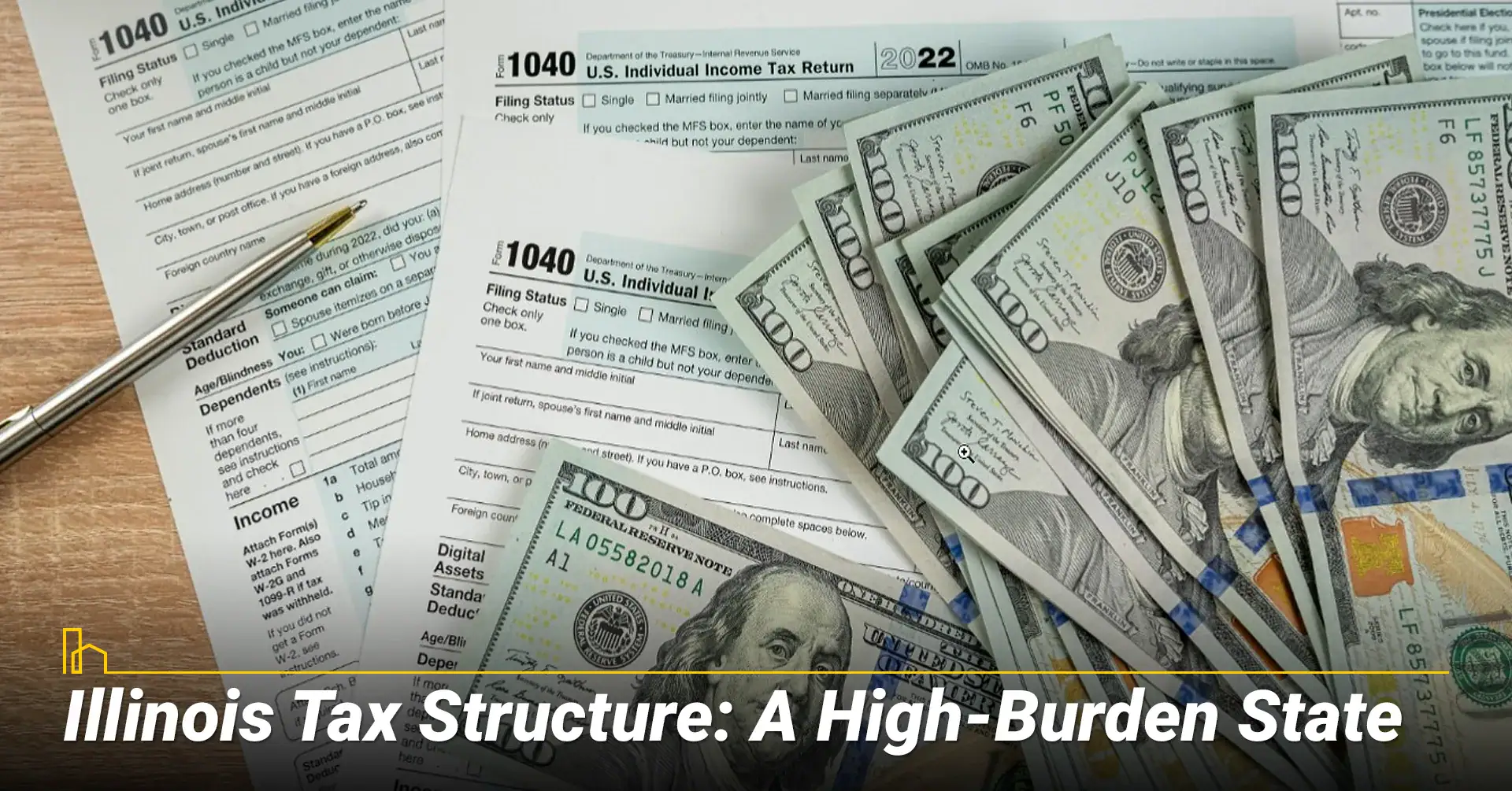

2. Illinois Tax Structure: A High-Burden State

A. Illinois State Taxes Overview: Illinois’ tax structure is among the most challenging in the nation. The state has a flat income tax rate of 4.95% for all residents, which provides simplicity but can be regressive for lower-income households. However, the most significant burden comes from property taxes, which are the second-highest in the nation. Sales taxes also add to the burden, with combined rates often exceeding 10% in many municipalities.

B. Tax Comparison: Illinois vs. Other States

Tax Type | Illinois | Indiana | Wisconsin | Missouri | National Avg. |

|---|---|---|---|---|---|

| State Income Tax | 4.95% Flat | 3.23% Flat | 3.54%-7.65% | 1.5%-5.3% | ~5.1% |

| State Sales Tax | 6.25% + local | 7.00% | 5.00% | 4.225% | ~6.35% |

| Avg. Combined Sales Tax | ~8.82% | ~7.00% | ~5.43% | ~8.29% | ~7.12% |

| Avg. Property Tax | 2.07% | 0.81% | 1.68% | 0.97% | 1.07% |

| Social Security Taxed? | No | No | No | No | N/A |

3. Daily Living Expenses in Illinois

Illinois’ overall cost of living is roughly 10% higher than the national average, but daily expenses tell a more nuanced story. For a more balanced , you can read about the cost of living in other states.

A. Monthly Living Costs Breakdown

Expense Category | Illinois Cost | National Comparison |

|---|---|---|

| Groceries (per person) | $327/month | 2% above average |

| Utilities (Monthly Avg.) | $150-$250/month | Near national average (3% lower) |

| Gasoline | ~$3.80/gallon | Slightly above average |

| Healthcare (individual) | $450-$550/month | 4% above average |

| Internet | $70-$100/month | Near national average |

B. Cost-Saving Strategies for Illinois Living: Smart Illinois residents mitigate high costs by

- Commuting Smart: Many Chicago-area residents use public transit (CTA, Metra) to avoid parking and gas costs. Those living near the border of Wisconsin often drive into Wisconsin to get cheaper gas. This is only worth it for those very close to Wisconsin, and not a viable strategy otherwise.

- Shopping Sales & Buying in Bulk: Many Illinoisans rely on places like Sam’s Club for buying in bulk, and on places like Aldi for affordable, high-quality groceries.

- Energy Efficiency: Investing in energy-efficient appliances and home insulation to combat both summer AC and winter heating costs is a possibility. However, even with these changes, many residents struggle to deal with electrical costs associated with energy, due to the constantly fluctuating weather and temperatures that living in Illinois means dealing with

- Utilizing Public Resources: Taking advantage of Chicago’s free museums, parks, and cultural events for entertainment. Libraries in Illinois are used widely for entertainment, from movie rentals and book checkouts to fun workshops. Local businesses such as coffee shops offer fun hangout spots for teenagers and adults, but the costs are higher than at chains.

The Pros and Cons of Living in Illinois (updated)

Illinois offers a diverse mix of urban and rural living, from Chicago’s skyline to peaceful farmland. The pros include culture, education, and location; cons include taxes and weather. This guide explores the pros and cons of living in Illinois to help you choose the best community for your lifestyle…

4. Family Life in Illinois: Education and Community

Illinois offers excellent educational opportunities with strong community bonds, though educational quality varies significantly across districts.

Education in Illinois: School quality differs dramatically between districts. Suburban districts like New Trier, Naperville, and Stevenson are nationally ranked and highly competitive. However, Chicago Public Schools face challenges despite significant investment and improvement efforts. The state offers a robust network of private schools along with selective enrollment options in urban areas. Illinois has strong public universities, including the University of Illinois system. Educational “affordability” can hinder Illinoisans from seeking higher education, according to Peter Hancock, writer for Capitol News Illinois at WGLT.org. He explains that “average tuition and fees at a four-year public institution in Illinois costs about 19% of a median household’s annual income (Hancock). Alternatively, “community colleges are dedicated to developing, promoting, and expanding workforce training options” and “many colleges have adopted transfer agreements” between community colleges and universities (Al Naber).

Family Expense | Illinois Cost | Available Support |

|---|---|---|

| Childcare (Monthly) | $1,200-$1,600/month | State assistance programs available |

| Youth Sports | $150-$400/season | Community leagues vary by income |

| 4-H & Outdoor Programs | Varies | Very accessible in rural areas |

| Private School Tuition | $10,000-$25,000/year | Financial aid available at many schools |

The 5 Best Places to Live in Illinois: A City Comparison

Illinois blends world-class cities, small-town charm, and rich farmland, offering diverse lifestyles across the Prairie State. This guide highlights the five best Illinois cities to live in 2025, based on affordability, opportunity, safety, and quality of life—from Chicago’s vibrancy to Urbana-Champaign’s academic appeal in the heart of the Midwest.

5. Illinois Transportation: Urban vs. Rural Options

Transportation in Illinois reflects the state’s urban-rural divide, with excellent public transit in Chicago and car dependency elsewhere.

A. Vehicle-Related Expenses

Transportation Cost | Illinois Average | National Comparison |

|---|---|---|

| Auto Insurance | $1,500-$2,000/year | Above average (especially in Chicago) |

| Gas Prices | ~$3.80/gallon | Slightly above average |

| Vehicle Registration | $151/year | Based on vehicle type and age |

| Annual Mileage | ~12,500 miles | Above average in Chicago area |

B. Public Transit and Air Travel

- Chicago has one of the nation’s best public transit systems (CTA, Metra, Pace) serving the metro area.

- Other Cities: offer limited public transit, making cars essential. Some towns have walkable areas, and many suburban areas have bike trails and paths that allow people to get where they want to go without paying for gas.

- Air Travel: Chicago O’Hare and Midway airports provide excellent domestic and international connectivity.

The 5 Best Places to Live in Illinois: A City Comparison

Illinois blends world-class cities, small-town charm, and rich farmland, offering diverse lifestyles across the Prairie State. This guide highlights the five best Illinois cities to live in 2025, based on affordability, opportunity, safety, and quality of life—from Chicago’s vibrancy to Urbana-Champaign’s academic appeal in the heart of the Midwest.

6. Illinois Job Market and Income Potential

Illinois’ economy is diverse, with strong sectors in finance, manufacturing, healthcare, and technology concentrated in the Chicago area.

A. Income Statistics and Employment

Income Metric | Illinois | National Average |

|---|---|---|

| Minimum Wage | $14.00/hour | $7.25/hour |

| Median Household Income | $72,000 | ~$75,000 |

| Unemployment Rate | ~4.5% | ~3.9% |

B. Major Illinois Employers and Industries

Industry | Key Companies/Employers | Typical Salary Range |

|---|---|---|

| Finance | CME Group, Northern Trust, Discover | $60,000 – $200,000+/year |

| Healthcare | Northwestern Medicine, Rush, Advocate | $50,000 – $150,000/year |

| Manufacturing | Caterpillar, John Deere, Boeing | $45,000 – $120,000/year |

| Technology | Google, Salesforce, Motorola Solutions | $70,000 – $180,000/year |

| Education | University of Chicago, UIUC, CPS | $40,000 – $100,000/year |

7. Cost of Living Comparison: Illinois vs. Other States

Expense Category | Illinois | Indiana | Wisconsin | Missouri |

|---|---|---|---|---|

| Median Home Price | $250,000 | $235,000 | $280,000 | $240,000 |

| Rent (2-Bedroom) | $1,300 | $1,100 | $1,150 | $1,000 |

| Gas Price/Gallon | ~$3.80 | $3.25 | $3.30 | $3.15 |

| Utilities (Monthly) | $200 | $180 | $190 | $170 |

8. Illinois Lifestyle: The Ultimate Trade-Off

Illinois lifestyle combines world-class cultural amenities with high costs: excellent dining, arts, and entertainment are balanced against significant tax burdens and urban challenges. These benefits are balanced against high living costs, traffic congestion in urban areas, and weather extremes.

A. Lifestyle Advantages of Illinois Living: The ability to access world-class museums, enjoy diverse cuisine, and benefit from strong educational institutionsis unparalleled. A sense of community and connection to both urban and natural environments provides a quality of life that is difficult to quantify but deeply felt by Illinois residents.

B. Illinois Living Challenges: The state’s high tax burden is the most significant hurdle for residents. Access to affordable housing in desirable areas, traffic congestion in the Chicago metro, and winter weather can be challenging for newcomers and longtime residents alike.

7 Most Affordable Places to Live in Illinois

Illinois offers more than its big cities and farmland—it’s also one of the Midwest’s most affordable states. With low median home prices and a diverse economy, it attracts families, retirees, and remote workers alike. This guide reveals seven budget-friendly Illinois communities for 2025, balancing cost, comfort, and Midwestern charm.

9. Best Places to Live in Illinois for Different Needs

A. Family-Friendly Illinois Communities

Community Type | Best Cities | Median Home Price | Key Benefits |

|---|---|---|---|

| Urban Family | Naperville | $450,000 | Top schools, amenities, near Chicago jobs |

| Affordable Family | Springfield | $155,000 | Good schools, low costs, state capital jobs |

| Rural Family | Galena | $225,000 | Historic charm, tourism economy, natural beauty |

B. Professional and Retiree Options

- Chicago provides the most diverse corporate and cultural opportunities across all sectors.

- Naperville offers excellent schools and suburban amenities with a strong corporate presence.

- Champaign-Urbana is a hub for education and technology with a lower cost of living.

- Galena and Geneva are premier retirement destinations for their historic charm and surrounding nature.

Conclusion: Making Illinois Living Work for You

Success in Illinois depends on choosing the right location for your budget and career, preparing for the climate, and embracing either an urban or a community-oriented lifestyle. While the cost of living is high in many areas, strategic financial planning and a willingness to engage with the state’s diverse opportunities is vital. For those drawn by opportunities for career advancement, cultural richness, and educational excellence, Illinois offers a rewarding lifestyle with unique challenges and benefits.

Recommended for you

Frequently Asked Questions About Living in Illinois

1. What is a comfortable salary to live in Illinois?

A single person can live comfortably on an annual salary of $60,000-$70,000 in most areas outside Chicago. In the Chicago metro area, a salary of $75,000+ is recommended for comfortable living. A family of four typically needs a combined income of $100,000+ to cover housing, taxes, and living expenses without living paycheck to paycheck

2. Is Illinois a tax-friendly state for retirees?

Mixed. Illinois is tax-friendly for retirees in some ways but challenging in others. The state does not tax Social Security income, which is a significant benefit. However, high property taxes and sales taxes can offset this advantage for retirees on fixed incomes.

3. How do people afford housing in Illinois?

Illinois residents afford housing by choosing locations that balance commute times with housing costs, utilizing public transit to reduce transportation expenses, and carefully budgeting for property taxes. Many also rent or take advantage of the state’s diverse housing market, from urban condos to suburban single-family homes.

4. Is healthcare more expensive in Illinois?

Healthcare costs are generally at or slightly above the national average. The Chicago area has world-class medical facilities (e.g., Northwestern Memorial, Rush University), but health insurance costs can be high. Rural areas and suburbs often have limited specialized care, requiring travel to urban centers.

5. What are the biggest hidden costs?

Hidden costs to watch out for are property taxes (which can equal mortgage payments in some areas), high auto insurance rates in urban areas, parking and transportation costs in Chicago, and winter-related expenses including heating and vehicle maintenance, as well as air conditioning costs in the hot, humid summers.

6. Is Illinois a good place to raise a family?

It can be an excellent place to raise a family. The state offers outstanding educational opportunities, diverse cultural experiences, and strong communities. However, families must carefully consider the qualify of school districts, housing costs, and tax burdens when choosing where to live.

If you’re considering other options, you might explore the pros and cons of living in Tennessee, the pros and cons of living in Texas, or the pros and cons of living in Colorado. For those interested in affordable places in Colorado or cheapest places to live in Texas, we have comprehensive guides available. You might also consider best places to live in Georgia or best places to live in Ohio as alternatives.

Local Editor(s)

Moving to Illinois: The Complete Relocation Guide & Checklist

Moving to a new state can be both exciting and overwhelming, and Illinois offers a unique mix of big-city energy and small-town comfort that makes it an appealing destination for…

The Pros and Cons of Living in Illinois (updated)

Relocating to a new state requires careful consideration of both the state as a whole and the specific community you'll join. If you're considering Illinois, you'll find a state home…

7 Most Affordable Places to Live in Illinois

In a nation where housing costs continue to climb, Illinois stands out—not just for its vibrant cities and rich agricultural heritage, but for the remarkably affordable cost of living in…

The 5 Best Places to Live in Illinois: A City Comparison

Illinois is a state of remarkable contrasts between towns, villages, and cities, where world-class urban centers coexist with charming small towns and fertile farmland. Choosing the right community within the…

What to Know About Parking in Chicago, Illinois

Chicago, Illinois, is one of the most beloved American cities, and for a good reason. It has Professional sports teams, unique food options, and exciting history. The excitement of the…

7 Key Factors to Know About Living in Chicago, Illinois

Is Chicago a good place to live? The answer to this question is Yes! Chicago, which sprawls over a 234-square-mile area on the shores of Lake Michigan, has many nicknames,…

7 Most Affordable Places to Live in Iowa (updated)

In a nation where housing costs continue climbing, Iowa stands out—not only for its rolling farmland and friendly communities, but for its remarkably affordable cost of living. With a median…

The 9 Best Places to Live in Indiana in 2025

When young professionals are looking for a place to settle down, Indiana is often overlooked. The “Hoosier State” can sometimes take a back seat to places like Texas, New York,…

The Pros and Cons of Living in Vermont

Tucked into the heart of New England, Vermont offers postcard-worthy landscapes, a relaxed pace of life, and a strong sense of community. Known for its maple syrup, fall foliage, and progressive values, this small state is big on character. But…

The Pros and Cons of Living in New York

Relocating to a new state requires careful consideration of both the state as a whole and the specific community you'll join. New York offers a state of extremes—home to the world's most iconic city, vibrant upstate towns, and breathtaking natural…

The Pros and Cons of Living in Idaho

When picturing Idaho, many envision snow-capped mountains, pristine lakes, and the iconic Snake River Canyon. Yet there's far more to Idaho than its postcard scenery. If you're considering a move, you'll find a state celebrated for its rugged beauty, expanding…

Pros and Cons of Living in Michigan

Relocating to a new state requires careful consideration of both the state as a whole and the specific community you'll join. If you're considering Michigan, you're in luck---the Great Lakes State offers diverse options for all ages, budgets, family situations,…

Considering

Considering