Why insurance gives first-time Home Buyers peace of mind

- Author:by Gloria Russell

With daily news about disasters of one type or another, one can’t escape the dismal message that unexpected things can happen without warning. Insurance isn’t always the sexiest topic, but there comes a time when we need to take notice and make sure we have protected our loved ones and our personal property to the best of our ability.

In this article, we’ll discuss why insurance is so important to the first-time home buyer and help you make sure you’ve got this covered. Buying your first house is a major decision, and after all your hard work to finally call that house your home, you want to protect your investment. Let’s talk insurance.

Table of Contents:

1. First steps to insuring your property.

Look for an experience insurance agent with a history of insuring homes like yours (or the one you want to buy). If you don’t have an agent, you can ask for referrals from trusted friends or colleagues. You can also check online for information about their company and read reviews from their clients. You want to find someone you can trust because if you are not getting good information, you may end up with a disappointing claim and coverage in the future.

My personal preference is to have a local insurance agent. I like the fact that I can call (and get an answer) and that, if needed, I can go in to see the agent face-to-face. This is a personal choice, but I much prefer knowing who I’m working with rather than dialing 1-800 number.

Once you have your insurance policy in place, you want it to provide peace of mind, knowing that you have done your due diligence, confirming the credibility of your insurance agent and company, and receiving answers to your questions that make sense for your situation. A good insurance agent will also be happy to evaluate your coverage each year to see if your circumstances have changed or if there have been changes in the insurance world that could affect you.

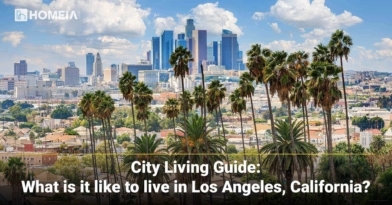

12 Key Factors to Know About Living in Los Angeles

No matter your reason for considering relocating to Los Angeles, you will find a lot to love in this sunny, warm, sprawling, diverse city. In this article, we will give you a feel for L.A.’s standard of living, climate, housing, education and more. Here are 12 Key factors you should know before moving to Los Angeles, California…

2. Why insure your property?

This seems like a pretty basic question, but we often hear people say that they don’t need much insurance or that they asked their agent for the most basic, least expensive insurance possible. Yes, an agent can provide that, but it might be better to ask your agent for a recommendation of what would be a reasonable level of insurance and then ask questions about each category of coverage and what that would mean to you.

If a disaster hits, you want to know ahead of time how it could affect you and your family. Ask questions. Disasters can come in all sizes. We’ve seen huge disasters lately, from hurricanes and flooding to fires and tornadoes. There are other misfortunes that cause heartaches for homeowners too: heavy winds, hail, ice dams, vandalism, theft, and accidents.

No one wants to think of these things or even carry the thought in their head for too long, but if you take the time to understand your insurance needs, you’ll sleep better at night.

There are also those odd occurrences that no one expects to happen at all, like the time my colleague’s daughter drove the family car through the front door into the living room. Then there was the time my water softener malfunctioned and flooded the lower level.

And, we must not forget the time the red squirrels got into the lake house and chewed up the woodwork and furniture. I’m sure you remember incidents like these too. It’s never a fun time, but if you have a conscientious agent and good coverage, you’ll feel better about the outcome.

The other side of the “why insure” question is that when you apply for a mortgage to buy your home, the lender will likely insist that you carry adequate insurance to protect your investment.

10 Most Affordable States to Buy a House in 2024

If you have the flexibility to move anywhere in the U.S., where could you buy the cheapest home? After examining data from Zillow and World Population Review. Here’re 10 most affordable States in the South and the Midwest to consider when buying a house in 2024…

3. What to look for when insuring your single-family home.

Insurance is complicated. That’s why we rely on honest, well-informed agents. It’s always good to do some of your own research and talk openly with your agent. There is no such thing as a stupid question. This is your agent’s career, and providing you with answers that make sense should be the priority. After all, the agent wants to serve you well, look you in the eye, and say, “We’ve got you covered. Sleep well.”

Here are some basics to discuss with your agent:

- Talk about broad coverage for any damage that may occur to your home.

- Liability insurance covers you if someone gets hurt on your property or gets bitten by your dog. It covers bodily injury and property damage. Discussing the tiers of coverage with your agent will help you determine which level will provide enough protection to cover your assets.

- In case disaster hits, you want your policy to cover the cost to rebuild your single-family home. Ask questions about what type of disasters are covered. In some areas, you might need extra coverage for certain catastrophes such as flood or earthquake.

- If you need to rebuild, re-shingle or re-side your home, replacement cost coverage will help you put your home back to the condition before the unpleasant event.

- Discuss additional coverage if you have some expensive items such as collections, jewelry, furs, art, expensive computer equipment, etc.

- Ask about coverage for additional living expenses. If your home is damaged so that you can’t live there and need to stay in a hotel or rent elsewhere, you’ll need help with the additional expenses.

- Ask about an umbrella policy for added protection and broader coverage if you need to protect assets beyond the standard liability limits.

Recommended for you

4. Make a home inventory list.

Document your belongings. Make a list. Take photos or make a video. If disaster strikes, it’s difficult to remember everything you had in your home. If there is a theft, some missing items can go unnoticed for a while. Who can remember everything when your world is turned upside down? If you take the time to make a complete list of your personal property and its value, you’ll be ahead of the game if you have a claim.

Hopefully, you’ll never need to use it, but it’s time well spent. Put a copy in your safe deposit box, fireproof safe or share a copy with a friend or family member.

You can insure your belongings for actual cash value which pays less for older items (and you will pay more to buy new) or you can insure for replacement cost which covers the price of buying new. The second option, though usually a bit more expensive, is typically advisable unless you would replace most items at a second-hand store or garage sale anyway. If you had previously been renting, you’ll likely be familiar with this portion of the insurance checklist.

The Cost of Living in California vs Texas in 2023

Both California and Texas have not only the largest populations but the largest habitable landmass of any of the U.S. states. This means there are not a lot of statements that can be made which represent either state in totality. We’ll let you know here the general cost factors to consider when making a decision to relocate to either state…

5. Celebrate the occasion.

Once you’ve done your homework and purchased adequate insurance, you can sit back, relax and enjoy “Groundhog Day,” the Bill Murray comedy classic featuring the high school classmate who is now an insurance agent. Definitely good for a laugh. Or, you can take yourself on a whirlwind passage with “Twister” or “Wizard of Oz” remembering that it’s all just a dose of showbiz.

Congratulations on being a first-time homeowner and learning the basics of property insurance for single-family homes. You have a lot of resources that can help you, from articles like this one, internet resources, your realtor, mortgage broker and insurance agent.

There are good reasons to carry adequate levels of insurance and to document your personal possessions. Ask your questions and make your decisions with confidence. You’ll enjoy the peace of mind that insurance can help provide.

If you have enjoyed this article and have a better idea of why insurance is so important and how to cover your assets, please share it with a friend who might also benefit. Thank you and sweet dreams in your new home!

Recommended for you