The Advantages and Disadvantages of a Contract for Deed

- Author:by The HOMEiA Team

- Category: Buy House , Real Estate Investing

A Contract for Deed is a type of sales contract used in the purchase of real property, and there are about half a dozen commonly asked questions on this topic. We will explain them to you here in this article. Let’s get started.

The principal feature of the Contract for Deed that sets it apart from other types of real estate purchase agreements is that in a Contract for Deed, the seller is the party financing the transaction.

Instead of a conventional lender, such as a bank, credit union or mortgage company financing the outstanding balance of the purchase price, in a Contract for Deed, the seller plays the role of the lender.

Table of Contents:

- 1. What is a Contract for Deed?

- 2. What Components Are Included in a Contract for Deed?

- 3. What Are the Pros and Cons of a Contract for Deed?

- 4. What Are the Advantages and Disadvantages of a Contract for Deed?

- 5. What Is Your Best Contract for Deed Advice for Minnesota?

- 6. How Can I Terminate or Get Out of a Contract for Deed?

1. What is a Contract for Deed?

A Contract for Deed is a non-conventional, alternative means of financing a real estate purchase transaction. Contracts for Deed are utilized in approximately 5% of all residential real estate sales transactions nationally. The vast majority of buyers and sellers, 95%, utilize banks and mortgage lenders to originate and service real property loans.

Real estate sales professionals and attorneys sometimes refer to a Contract for Deed as a type of “creative financing.” Contracts for Deed have also been known by other names, including:

- a) Land Contract

- b) Land Sale Contract

- c) Land Purchase Agreement

- d) Simple Land Contract Purchase Agreement

There are reasons why these names incorporate the word “land.” Contracts for Deed were originally conceived for real estate sales transactions involving raw land, such as farms, ranches, grazing land, mountainous property and land earmarked for development.

Conventional lenders are often reluctant to lend their funds on raw land because land values are more volatile and more speculative than residential and commercial properties.

Residential and commercial properties tend to have more market value stability and are easier to appraise, since they have a significant portion of the value of the property tied to the property’s structures, location, and highest and best use.

10 Most Affordable States to Buy a House in 2024

If you have the flexibility to move anywhere in the U.S., where could you buy the cheapest home? After examining data from Zillow and World Population Review. Here’re 10 most affordable States in the South and the Midwest to consider when buying a house in 2024…

Land, on the other hand, is subject to unpredictable market factors like changes in zoning, changes in usage-related laws, changes in the overall economy, development in the area, or lack thereof, and natural disasters like fires and floods.

Raw land properties are difficult to appraise, and in a banker’s mind, much riskier. Banks are often unwilling to lend on raw land transactions at all, and when they do, they typically require an annual percentage rate several percentage points above a comparable residential or commercial sale transaction, plus a sizeable down payment.

The contract for Deed (owner) financing transactions are now being used more and more in residential transactions, for a variety of reasons. Contracts for Deed jumped into the lending spotlight after the 2009 real estate market melt-down, due to credit tightening by conventional lenders.

Conventional loans were suddenly unavailable to home buyers who in normal market conditions would have easily qualified for financing. Capital typically available to initiate residential loans dried up.

Buyers and sellers both needed a means for completing their sales transactions, and the Contract for Deed became the go-to lending mechanism. The utilization of Contracts for Deed in financing residential real properties in Minnesota doubled from 2007 to 2010.

10 Most Affordable Places to Live in Michigan

Michigan is the only state in the United States with two separate peninsulas and five surrounding Great Lakes. Its landscape is diverse, ranging from industrialized skylines to sweeping sand dunes to gorgeous waterfalls. Once home to Henry Ford, it’s also considered the epicenter of America’s…

Since 2009, Contracts for Deed have remained a viable mechanism for all types of real property financing, especially for those buyers who may have difficulty qualifying for a conventional loan. These reasons may include:

- a) poor credit rating

- b) insufficient collateral

- c) insufficient down payment

- d) employment changes

- e) sporadic employment history

- f) high personal debt to income ratio

Housing advocacy organizations have begun to use the Contract for Deed as a means to help low- and moderate-income households attain homeownership.

10 Most Affordable Places to Live in Oregon

Geographically, Oregon boasts dramatic Pacific coastlines as well as volcanic mountain ranges. Its climate spans from rainforests along the coast to semi-arid conditions in the central and southeastern regions. The Beaver State is home to both Crater Lake, the deepest lake in the U.S., and Mount Hood, the second-most-climbed mountain in the world…

In a real estate sales transaction using a Contract for Deed, the buyer agrees to pay the purchase price of the property in monthly installments, just like a conventional loan. Normally, the buyer takes immediate possession of the property with full rights of occupancy.

However, in this case, the seller retains legal title (deed) to the property until the terms of the Contract for Deed have been fulfilled. The property thus becomes the seller’s security.

The Contract for Deed financing option is usually a faster and less costly way to finance the purchase of real estate. There are no lengthy and intrusive loan applications to complete. There are no loan origination fees, and usually no closing and settlement costs.

The process of foreclosure, in the event of default on the loan agreement, is generally much simpler and faster.

Laws regulating the Contract for Deed vary from state to state, and sometimes county to county, so if a buyer or seller is contemplating owner financing, both parties should become well informed on pertinent legal issues before entering into an agreement.

A Contract for Deed is truly a form of creative financing because the two parties to the agreement can structure many features of the loan any way they choose. A bank, for example, may have a rigid policy regarding down payment. They may require 10% or 20% or even more as a down payment.

Contracts for Deed often have no down payment at all. The buyer simply begins making monthly payments, according to the terms of the contract.

10 Most Affordable Places to Live in Florida in 2024

With year-round warm weather and over 8,000 miles of coastline, it’s no wonder Florida is a prime vacation destination. Filled with wildlife, beaches, lakes, rivers, amusement parks, diverse entertainment options and much more, the population of Florida is growing with people that want to call Florida “home,” soak up the sun…

There are some who view the “no-down-payment” Contract for Deed as just a form of “rent-to-own” where the buyer’s monthly rent payments go toward a future down payment or are applied to the principal of the loan, thereby increasing the renter’s potential future equity. With no down payment, the two agreements are similar, but with important differences.

In a rent-to-own or lease-to-own agreement, there is often an up-front option payment which acts like a down payment. Also, the owner of the property continues in his role as landlord, therefore responsible for maintenance, taxes and insurance.

Under a typical Contract for Deed, the buyer assumes the normal responsibilities associated with property ownership, including property taxes, property maintenance and insurance. Also, the buyer can make home improvements and modifications to the property.

Another important difference is that in a typical Contract for Deed, either party has the right to sell his interest in the contract.

However, since most aspects of a Contract for Deed can be structured in any way the two parties agree to structure it, all of the above factors can be handled differently, as long as both parties agree to the terms.

State laws pertaining to Contracts for Deed normally require both parties to the agreement to record the sale with their local county recorder’s office, or registrar of titles, within a specified period after signing.

Minnesota law, for example, requires that all transfers of real property be recorded with their county’s recorder office within four months of the transaction. Failure to do so can result in a fine.

However, these transactions often go unrecorded, due to the lack of sophistication on the part of both parties to the agreement. For that reason, it is difficult to know exactly how prevalent these contracts are because the nature of the agreements allows for a higher degree of the buyer and seller anonymity.

Recommended for you

2. What Components Are Included in a Contract for Deed?

A Contract for Deed includes the following information:

- a. Identity of the Seller

- b. Identity of the Buyer

- c. The legal description of the property

- d. Selling price

- e. Terms of the payment plan

The language of the contract needs to include specifics regarding:

- a. Property insurance

- b. Property taxes

- c. Down payment, if any

- d. Loan interest calculation

- e. Late payment penalties

- f. Default protocols

10 Most Affordable Places to Live in Tennessee

Travel aficionados who are looking to fill up their bucket list with various visits to fun U.S. states should most definitely pencil in Tennessee as one of their destinations. The people in the so-called Volunteer State (Go Vols!) are genuinely friendly folks who never fail to provide visitors with…

CALCULATION OF PAYMENTS

Monthly payments in a Contract for Deed are normally amortized, the same way payments are amortized in a standard purchase-money mortgage. A portion of the monthly payment is used to satisfy the interest for that period, and the remaining portion is applied toward the principal. Buyer and seller normally review current market mortgage rates and negotiate a rate agreeable to both parties.

The loan can also be structured as an interest-only loan, where the monthly payment is 100% interest, and none of the payment is applied to the principal. These monthly installments are usually lower than a typical amortized loan. However, the buyer does not build any equity in the property as long as the interest-only loan agreement is in place.

Interest-only loans usually have a “balloon payment” after a period of time, perhaps five years. At that time, the buyer becomes obligated to pay the outstanding balance of the purchase price to the seller in full.

Typically, this will require the buyer to refinance the loan, usually with a conventional lender, or it will require the buyer to sell his interest in the property. Balloon payments are also a fairly common feature in Contracts for Deed, including contracts that incorporate fully amortized loans.

The 10 Cheapest Places to Live in Texas

They say everything is bigger in Texas, and for good reason. From some of America’s largest and active metropolitan cities to the host of recreational activities for people of all ages across the state to the many bigger-than-life personalities who call Texas home, Texas has plenty to offer for everyone. here’s the list of 10 lowest cost of living places…

PURCHASE DEFAULTS

The Contract for Deed should include language that defines when an installment payment is late.When a payment is late, the buyer will be levied a late fee, which is spelled out in the terms of the agreement. The buyer is given a grace period in which he has the opportunity to remedy the default.

If the buyer is unable to remedy the default within the grace period, he is given a specified period of time to pay off the outstanding portion of the purchase price (acceleration clause). He must also vacate the property within the timeframe as specified in the contract.

If the buyer remedies the default, the seller has the option of reinstating the terms of the original agreement, or he can reclaim full ownership in the property, evict the buyer and keep all monies paid against the loan up to that point in time.

INSURANCE

The buyer normally assumes the responsibility for securing insurance to cover the subject property, liability insurance and coverage for all his personal property. If some of the seller’s personal property remains on or within the subject property, the seller is responsible for securing insurance on those items.

10 Most Affordable Places to Live in Colorado

Given the outdoors benefits – the cost of living in Colorado is still one of the best values in the country. Here’re the 10 most affordable places to live in Colorado, taking into account the cost of living, median housing price, average crime rate and other factors that make the place unique…

PROPERTY TAXES

The buyer normally assumes the responsibility for all future property taxes, once the agreement is executed.

DISCLOSURES

The laws pertaining to disclosure requirements vary from state to state. Generally, the seller is required to disclose any known defects in the physical condition of the property that could materially affect the property’s value.

This could include plumbing problems, issues with the house’s foundation, pests, malfunctioning appliances, like air conditioning and kitchen fixtures, structural issues with the home, roof leaks, etc. Disclosure could also include construction and/or demolition projects which are planned for the neighborhood.

The Cost of Living in California vs Texas in 2023

Both California and Texas have not only the largest populations but the largest habitable landmass of any of the U.S. states. This means there are not a lot of statements that can be made which represent either state in totality. We’ll let you know here the general cost factors to consider when making a decision to relocate to either state…

3. What Are the Pros and Cons of a Contract for Deed?

The Pros

Speed of execution is one of the most attractive features of a Contract for Deed transaction. A buyer could literally view the property for the first time in the morning and have a fully executed agreement in place by that evening, then take possession of the property the following day. It may not be in either party’s best interest to move that quickly, but it could be done.

By contrast, a conventional, thirty-day escrow closing period is considered a short time frame within the real estate industry. Just the loan approval process can oftentimes take weeks to complete.

This speed of transaction may be advantageous for both parties. The seller may be strapped for cash and need immediate income to satisfy personal obligations.

The buyer may be under some pressure to complete the transaction quickly due to some requirement for him to vacate the property his is currently residing in, such as the termination of a lease, or the closing of a sale on his previous home.

First-time buyers or individuals who lack experience in the real estate marketplace may prefer a Contract for Deed because of the relative simplicity of the buying process. The Contract for Deed is also an attractive option for buyers, who for some reason, do not qualify for conventional loans.

The 10 Best Places in the USA to Retire on the Water for Less

The popularity of the waterfront can mean high housing costs and consumer prices. Luckily, for those willing to look past the likes of Malibu and Venice Beach, there are plenty of scenic spots along the country’s lakes and oceans where retirees can make a nice home even with a reduced…

The Cons

The Contract for Deed option lacks many of the protections and safeguards that are afforded through the conventional purchase/lending system.

These protections are in place for a reason, and it would be wise, for both buyer and seller, to consider these protections and determine if any of them can be applied to their own transaction, in a more or less do-it-yourself approach.

For example, conventional lenders require that a title company be employed to ensure that title to the property is valid and unencumbered. If it is encumbered, in what way is it encumbered? Does the seller have outstanding loans against the property?

If the seller has the property already mortgaged, the new buyer may find himself in a junior position, should the seller default.

If the seller’s lender chooses to call in the seller’s outstanding loan and foreclose, the buyer, under the new Contract for Deed could literally lose the property, and all of his accumulated equity in the property up to that date.

The 10 Best Places to Live in Southern California

HOMEiA is here to help you explore ten of the best places to live in Southern California. Each place has its own charm and unique qualities. Let’s take a quick dive into what Southern California has to offer! Here’re 10 best places to live in Southern California…

Conventional lenders also require that a neutral, third party, an escrow company, review all documents prior to closing. The escrow company acts as another set of eyes on the transaction to help ensure that all transaction-related matters are in order.

Conventional lenders usually ask for a professional appraisal to be conducted on the property to ensure that the market value of the property lines up with the amount of the loan.

Another safeguard that a lender often requires is a property inspection, including a pest inspection. The property may have termites or structural defects that the seller himself is unaware of.

The language of the Contract for Deed may have provisions that could allow for abuse on the part of either party to the contract. These provisions can add an ongoing element of risk and uncertainty to the property transfer.

Recommended for you

4. What Are the Advantages and Disadvantages of a Contract for Deed?

The Buyer’s Advantages.

- a) Low down payment – A Contract for Deed typically requires a lower down payment, or no down payment at all.

- b) Homesteading – In Minnesota, by purchasing a home on a Contract for Deed, the buyer is eligible to claim the property as a homestead, and take advantage of property tax benefits, including the market value extension.

- c) Income taxes – The buyer can claim the mortgage interest deduction on his personal income taxes.

- d) Relaxed financing standards – The seller is most likely going to have less stringent underwriting standards, compared to a conventional loan.

- e) Low transaction costs – A Contract for Deed has no costs associated with originating the loan, including no origination fees, no points and no (high) closing costs.

- f) Home ownership – The Contract for Deed can provide a viable path to home ownership for a buyer who may have difficulty purchasing a property otherwise.

- g) Credit score – The purchase of a real property gives the buyer the potential of improving their credit score. However, it will only improve if the seller reports the buyer’s payments to the credit reporting agency. A smart buyer will add a clause into the contract requiring the seller to report his payments.

4 Best Places to Live in Minnesota for Families in 2024

Bordering Canada and the Great Lakes is a state fondly dubbed as the “North Star State” and “Land of 10,000 Lakes.” The state has a lot of lakes sprawled across its more than 86,000 square mile area. In a comprehensive study of cities, Minnesota is the number one state for raising a family because of its high median income, affordable cost of living and exceptional education services…

The Buyer’s Disadvantages.

- a) Lacks foreclosure protection – If the buyer defaults on his payments, or other conditions of the contract, the seller can reclaim the property without a foreclosure sale or any judicial action.

- b) Balloon payment risks – If the Contract for Deed has a balloon payment, and the buyer is unable to secure refinancing, the seller has the right to take possession of the property, according to the contract’s terms, and retain any and all monies previously paid toward the property’s purchase. If the balloon payment is scheduled at a five-year milestone, that means sixty months of monthly payments could be lost.

- c) Seller retains title – With the seller holding the property deed, that means he may be able to continue to encumber the property with mortgages and liens. This is one of the reasons that the transaction should be recorded within the appropriate county office immediately after execution.

- d) Consumer protections – Contracts for Deed are not afforded the same consumer protections that are found with conventional financing. This opens the possibility of an unscrupulous seller structuring the contract with terms unfavorable to the buyer.

- e) Seller assignment – If the seller sells his interest in the property to a third party, that new owner may not be favorable to the buyer for some reason. The buyer should ensure that he has an equal right to transfer his interest in the property, if desired.

- f) Property maintenance – A Contract for Deed usually states that the buyer is responsible for property repairs and maintenance. This additional investment on the part of the buyer raises his level of risk should he inevitably lose the property for some reason.

The 10 Most Affordable Places to Live in California in 2024

We assessed the cost of living across Californian cities and compared them to the national average. The cost of living is calculated based on 5 main categories: housing, food, healthcare, transportation and energy. Based on these calculations, we narrowed down the list to California’s 10 most affordable cities…

The Seller’s Advantages.

a) Sales potential – With an expanded pool of buyers, including those who cannot qualify for conventional financing, the buyer has a better chance of consummating a sale.

b) Income stream – The contract will provide a steady source of income for the seller, often at interest rates higher than he could obtain anywhere else.

c) Foreclosure – In case of default on the part of the buyer, the law allows the seller to cancel the contract, without judicial action, and take possession of the property, typically within sixty days. He can also retain all payments previously made by the buyer as liquidated damages.

The Seller’s Disadvantages.

a) Due on Sale Clause – Many sellers, whose property has an outstanding mortgage, mistakenly believe that they can sell the property and then wait to receive the balloon payment to pay off their existing mortgage. Most conventional loans have a “Due on Sale Clause.” When a Contract for Deed is executed, it will trigger the acceleration clause in the seller’s own mortgage, making the outstanding balance due and payable in full. The seller can avoid this by having his lender approve the Contract for Sale transaction in writing, in advance.

b) Default – If the buyer defaults on his obligations, the seller must follow the procedures mandated by law to formally cancel the contract and evict the buyer.

c) The balloon – Even with a reliable buyer who has made all payments on time, it may not be possible for him to arrange refinancing. In this case, the seller is faced with a difficult decision. Does he extend the contract period and allow the buyer to continue to make monthly payments, or does he cancel the contract and evict the buyer?

d) Property management – In order to safeguard his investment, the seller needs to monitor the payment of taxes and maintenance of insurance. He also needs to provide the buyer with an annual statement of interest paid for the buyer’s income taxes (if the contract calls for such a statement). The seller also needs to monitor the condition and maintenance of the property to protect his invested interest.

7 Key Factors To Know About Living in Denver, Colorado

The Denver area is growing in population much faster than most of the country, increasing by almost 20% from 2010 to 2018. It’s no wonder; it rates as the second-best place to live in the United States, according to U.S. News & World Report (2019). Here’re 7 key factors you should know Before living in Denver Colorado…

5. What Is Your Best Contract for Deed Advice for Minnesota?

ADVICE FOR BUYERS

a. Meet with a housing counselor to assess your finances and ability to purchase the property. A housing counselor may also discover that you qualify for a conventional loan, such as an FHA mortgage. A housing counselor may also be able to provide advice on how to improve your credit score or other factors that are impeding your ability to secure conventional financing.

b. Have a plan in place as to how you will pay off the balloon payment when it comes due.

c. Consider obtaining the services of an experienced, licensed real estate agent. A buyer’s agent will assist you in many ways.

d. He can prepare a market analysis of similar properties to ensure that you are not offering too much for the property.

e. He can help you negotiate the purchase price and financing terms.

f. He can obtain title work on the property and assist in the closing process.

g. Find out the seller’s position on the possibility of extending the contract. It is advisable to incorporate terms into the Contract for Deed language that addresses contract extension.

h. Have a real estate attorney review the contract documents prior to signing them. He can explain the terms of the contract and recommend modifications that will provide important safeguards against risks.

i. In addition to a real estate agent’s market analysis, you may want to secure an appraisal from an FHA-certified appraiser. He can also determine if the property qualifies for FHA financing. This may become important later because refinancing out of a Contract for Deed typically involves FHA financing.

j. Have the property inspected by a professional, third-party inspector. An inspector can also give you an estimation of the cost of repairs, or potential future repairs, which will further help in your assessment of the property’s value.

k. Purchase title insurance. The title company will do a title search and determine if there are any outstanding liens and encumbrances. The title company can also act like an escrow company and help you close the transaction.

l. Record the signed, notarized Contract for Deed with the county.

m. Create a budget for homeowner’s insurance, property maintenance issues and real estate taxes.

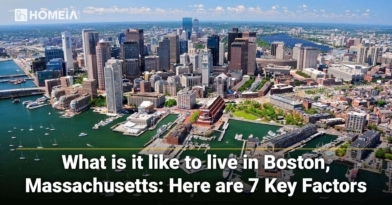

7 Key Factors to Know About Living in Boston in 2024

Before considering your move to Boston, we have compiled a list of 7 key factors we put together for you. Boston life is about the best city life you can imagine. Relatively small, it’s often referred to as the walking city, with world-class museums, universities, theaters, and gourmet dining…

ADVICE FOR SELLERS

- a) Be certain that the Contract for Deed is legal and complies with Minnesota law. The Minnesota Department of Commerce has a blank, “boilerplate” contract form that you can obtain.

- b) Utilize the services of a local licensed real estate agent to assist with the implementation of the Contract for Deed.

- c) Understand the buyer’s financial situation. If you feel it is appropriate, you can refer him to The Minnesota Home Ownership Center for free counseling.

- d) Provide for taxes and insurance in advance. If the buyer fails to pay property taxes or insurance, the property is at risk. An alternative way to handle these payments is to provide for them in the loan terms, with a small amount added to each monthly payment, or an annual payment that would provide a full twelve months of payments.

- e) Make sure that the interest rate you are charging is in compliance with Minnesota law by calling the Dept. of Commerce at 651-297-7053. This number will lead to a recorded message informing you of the current month’s maximum rate.

- f) Make sure that the buyer has a plan in place as to how he will satisfy the balloon payment.

- g) If you have any outstanding loans on the property, contact your lender for written permission to sell the property under your Contract for Deed.

- h) Clarify the responsibilities that you and the buyer have regarding taxes, insurance, access to the property, and property upkeep and maintenance.

Recommended for you

6. How Can I Terminate or Get Out of a Contract for Deed?

It behooves anyone who enters into a Contract for Deed to understand the terms of the agreement thoroughly and have a good understanding of the risks involved, prior to signing. A Contract for Deed is a legally binding contract, and once entered into, binds both parties to the terms of the agreement.

After entering into the contract, if the buyer believes that he has made a mistake, he only has recourse if he included a paragraph in the contract which allows him to transfer his interest in the property. If so, he can find a new buyer to assume his terms of the agreement.

In the case of the seller, he too can sell and transfer his interest in the contract to a third party.

The only other way to terminate a Contract for Deed is for the buyer to default. A default allows the seller to decide if he wants to cancel the contract and evict the buyer or extend the loan period.

7 Key Factors to Know About Living in Chicago, Illinois

Before you consider a move to Chicago, you should consider 7 key factors that will increase your appreciation for the city and guide you to the right neighborhoods and activities for you…

Additional Information

Minnesota residents who are seeking additional information on Contract for Deed financing or other questions regarding real estate purchase transactions, can contact the Dept. of Commerce directly:

Minnesota Commerce Department

Consumer Services Center

Email: consumer.protection@state.mn.us

Local: 651-539-1600

Greater MN only: 800-657-3602

7 Key Factors to Know About Living in Milwaukee, Wisconsin

If you want the variety, history, and entertainment options of a big city, but with shorter commutes and a laid-back Midwestern vibe, Milwaukee, Wisconsin may be the place for you. It has an upscale side, especially in trendy districts like the Historic Third Ward, and its proximity to Chicago…