Tips and Templates to Evaluate Single-Family Homes

- Local Editor:Local Editor: Gloria Russell

Published: Dec 10, 2017

- Category: Buy House , Real Estate Investing

Congratulations! You’re ready to start house hunting in search of a new home. Especially if you are a first-time homebuyer, it can be a lot to think about. By now, you might have begun to wonder about real estate showings and how it’s possible to look for all the essentials and not miss anything. How can you even remember it all after seeing multiple homes? How is it possible to compare and rate them fairly? There must be a less stressful way—and there is.

In this article, we’ll discuss how to organize like a pro and weigh in on the good, the bad and the ugly for every house you are viewing. With strategy and organization, you’ll be able to actually enjoy the home buying process. After all, you want to find the best home for your situation. Let’s develop a plan you can live with!

Table of Contents:

1. You must first understand your priorities.

When buying a single-family home, if you haven’t done so already, make a list of your “must-haves.” This is your list of features that are non-negotiable. You will not buy a house without them. They could be items such as a 2-car attached garage, 3 bathrooms, a child-friendly yard, a home office, etc. It doesn’t matter what’s on this list. What matters is that, to you, a house must absolutely have these items or you would not want to live there.

The 10 Best Places to Live in Oregon

Oregon is a study in contrasts. It has 363 miles of the most breathtaking coastline you’ll encounter anywhere in the world. But it also has dense forests, mountain ranges, and high desert country. Here’re the 10 Best Cities to Live in Oregon…

2. Make a list of your secondary “nice-to-have” items.

This list will help you understand what features you’d like if they are available, but you could get along without them if other factors weigh in more heavily. If there are two of you purchasing this home, have some serious conversation about your lists because you need to agree on what you each need to create a happy home. If you have children and/or pets, think about what will be important as you are caring for them: a safe environment, room to play, etc.

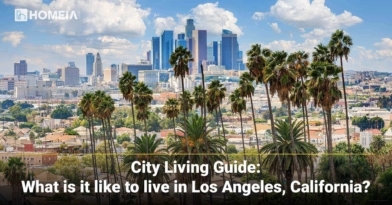

12 Key Factors to Know About Living in Los Angeles

If living in Los Angeles (or LA) is your reason for considering relocating to California, you will find a lot to love in this sunny, warm, sprawling, diverse city. In this article, we will give you a feel for L.A.’s standard of living, climate, housing, education and more. Below are top 12 key things to know about living in Los Angeles…

3. Organize with basic supplies and a plan.

To organize efficiently, buy:

- a 1-inch or 1.5-inch three-ring binder with pockets on the inside covers. Choose a happy color—you’ll be taking this with you to all showings.

- numbered tab dividers (1–34 and hope you’ll find the right house long before #34).

- a 3-hole punch, if you don’t have one.

- 5 x 11 paper (which you probably already have).

You will organize this binder so everything is in one place, and you’ll have all the information needed to remember each house and make meaningful comparisons.

Recommended for you

4. Prepare your binder and Summary Sheets.

Fill in your “must-have” list on the Summary Sheet template and make copies. Use the 3-hole punch to punch the holes and place a Summary Sheet in the binder for each tab.

Each house will receive a number. The first showing is House #1; second house on your showing list becomes House #2, etc.

You will take your binder with you to each showing, making notes as you go. If other information is given to you, write the appropriate House # at the top of that page when you get it, so you will know at a glance where the info belongs in the binder. You can punch it and put it in the binder with your notes for that showing when you get home. Everything will be together and organized, and nothing gets lost or misplaced.

The 10 Best Places in the USA to Retire on the Water for Less

The popularity of the waterfront can mean high housing costs and consumer prices. Luckily, for those willing to look past the likes of Malibu and Venice Beach, there are plenty of scenic spots along the country’s lakes and oceans where retirees can make a nice home even with a reduced…

5. Use your Summary Sheets to make relevant notes.

While viewing homes with your realtor, be sure to write the House # on each piece of paper that relates to that house. Check off Yes or No for items on your must-have list. If your must-have needs are not met, don’t waste any more time at that house. Move on to the next house.

Be observant and make notes in all areas on your Summary Sheet. Discuss all questions with your realtor. Be sure to check everything, everywhere. As a single-family home buyer, you are entitled to check out all details. Look in cupboards and closets. Check lights, fans and blinds. Make sure windows are operational and doors lock. Check water pressure, faucets, showers, tubs and toilets. Check all appliances and make notes of the condition.

Check the garage, door opener and lighting. Measure the garage to make sure your vehicles will fit. This sounds odd, but I’ve known more than one person who bought a house only to find out their car didn’t fit in the garage. Check the yard, landscaping, trees, retaining walls or other buildings. Make notes about the neighborhood and what it might be like to live there.

10 Most Affordable States to Buy a House

If you have the flexibility to move anywhere in the U.S., where could you buy the cheapest home? After examining data from Zillow and World Population Review. Here’re 10 most affordable States in the South and the Midwest to consider when buying a house…

6. Rank each home.

Do this after you’ve looked the house over and before you leave. If you have doubts or questions, you’ll still have time to go back and check something that is in question. When you get home, you can look over your sheets for that day and compare them further. You might change a few of the ratings if it makes sense.

When you are ranking each home, you have already determined that the property must have all features on your must-have list in Category #1. If not, say no and move on. Since this is non-negotiable, it needs no ranking because it must be there.

For the other categories, make notes so you’ll remember, and rank them with a rating of:

- 1 for Not Good (doesn’t make you smile and doesn’t work with your lifestyle and goals)

- 2 for Average (you can live with it and perhaps make it better)

- 3 for Good (you are happy with it and can possibly even improve it further).

Under Category #2: Important Considerations, you’ll make notes of the Pros and Cons you see and then rank this category as a whole.

Category #3 notes factors you don’t want to forget, and

Category #4 will remind you of work that needs to be done.

Category #5 lists questions that your realtor might know or can find out, or you might find out by driving by on another day at a different time of day.

Your Category #6 will let you know if the house fits into your financial plan. Ask about future assessments, tax hikes, etc. that might influence your decision.

Make one copy of the Tally Sheet and put it in the front of your binder. This is now Page 1 and will be a quick visual of your progress and how well the properties are fitting into your preferences. When you’ve been through a few houses, you’ll use your Tally Sheet to see how the properties are stacking up.

Recommended for you

7. Evaluate your results.

After viewing several homes, continue to check your Tally Sheet and Summary Sheets. You’ll eventually see a few homes rise to the top in ratings. Compare all homes that have a maximum score of 15. If none are at that level, move to the next highest number and compare. Continue until you have your Top 3. For those properties that make the grade, schedule a second showing.

While there, check the interior, exterior and grounds. Make additional notes and adjust your ratings if necessary. Ask yourself if you can imagine living there? Would it support your desired lifestyle?

Talk with your realtor about the value comparisons and financial impact of each property. Do a reality check on the financing and impact on your budget. Talk about the improvements that might be needed and calculate the costs. Are they cosmetic, mechanical or structural. Is it worth the time, money, inconvenience and effort?

With pre-determined priorities and an organized plan, this step of the home buying experience will likely be more fun than you expected. Using this system, you’ll find that the right real estate investment will soon become evident. And yes, it is an investment, as well as a home. Take your time to choose wisely. Stick to your budget, financial goals and must-have features. Look at everything with a realistic perspective.

With this plan, you’ll ask questions and benefit from your realtor’s experience and knowledge. You’ll make useful notes and rank the properties to find the home that best fits your criteria. You won’t be like the people who end up with a mess of unorganized listings and can’t remember one property from another. You will have a clear picture of what you want, what will serve you well and the confidence to make the offer.

As a home buyer, if you have enjoyed this article and feel more confident about your ability to evaluate real estate properties you’ve seen at showings, please share it with a friend who might also benefit. Thank you and happy house hunting!

Gloria Russell is the lead writer at Russell Resources LLC, a Minnesota-based company, serving clients across the country with business writing that sends a relevant message to a preferred audience. Her mission is to help businesses succeed and grow by creating original, written content for websites and articles and by editing and upgrading existing content. Having considerable experience in buying, selling and renovating homes as well as serving on association boards and managing complex projects, Gloria crafts insightful articles on current real estate topics. For more information, contact Gloria at [email protected] or 651-485-8826. Thank you!