The Beginner’s Guide on How to Buy a House

- Local Editor:Local Editor: Gloria Russell

Published: Aug 08, 2018

For a first-time home buyer, the process of buying a house can seem a bit intimidating. Yes, there are many steps to buying the house you’ll want to call home, and we can break it down into manageable pieces. As with any project, you’ll gain the confidence and desire to learn more, take it one step at a time and achieve your goals.

In this article, we’ll discuss those key steps to confidently buying your first home. We’ll also look at several professionals who can help guide you on the journey, so all the details are handled correctly and professionally. Let’s get started on your next adventure.

Table of Contents:

1. Know what you want

The best adventures start with some serious dreaming. Imagine where you’d like to go, how you’ll be spending your time and what means the most to you for lifestyle and convenience.

- Where is the best location?

- What will life be like in next 5-10 years?

- What will you be doing?

- How big is your family?

This is the first step. Dream about all the many factors in your life and how they will affect the decision of a location and style of home. Make a list of what will be important in your life and how the home can add to your level of enjoyment. You’ll want a location that will be convenient to friends, work, school, shopping and activities.

Look at a map and highlight those areas you will be frequenting the most. Then, draw a circle to indicate the area that would provide convenient access to your most-visited places. Check out the commute experience to see if it’s acceptable to you.

The 10 Best Places to Live in Oregon

Oregon is a study in contrasts. It has 363 miles of the most breathtaking coastline you’ll encounter anywhere in the world. But it also has dense forests, mountain ranges, and high desert country. Here’re the 10 Best Cities to Live in Oregon…

Once you narrow down the cities or suburbs that would align with your life’s activity, you can start zeroing in on specific neighborhoods. You’ll have time to dream a little here too, and the idea is to visualize what it would be like to live there and if it feels right to you. You can also check out the neighborhoods during different times of the day to see what’s going on and if it feels comfortable.

While you’re dreaming, throw in a little realism. Save what you can for a down payment, which can be from 3.5% to 20% of the purchase price. It’s also good to have some savings for those unexpected expenses that can come with homeownership. Saving is a good thing, but don’t get too nervous about not having enough. Do your best and, later, you’ll talk with your mortgage loan officer about creating the best plan for financing.

7 Key Factors to Know About Living in Miami in 2026

Miami is the only major U.S. city to have been founded by a woman. Arriving in 1891, native Clevelander, Julia Tuttle bought several hundred acres along the bank of the Miami River in an area then known as Biscayne Bay. Her passion to build a community in her newly found paradise…

2. Know what you need

Even before you start working with a realtor, you can start thinking about what style of housing will be best for you. If you’ve been renting, you can make a list of what you liked about it and where you’re ready for a change.

Whether you want something quieter, more spacious or more private, make notes about your preferences and must-have features. This list will be valuable in helping you stay on track and find the right home for this stage of your life.

Typical options are a single-family home, condo or townhouse. They each offer something different. If you want privacy, a backyard and a garden, you might opt for a single-family home. Or, if you travel a lot, dislike yardwork and cringe at outdoor maintenance projects, you might enjoy the convenience of a condo or townhome.

Whether priorities include an attached garage, home office, tennis courts or fenced-in yard, you’ll know which style of home is more likely to fill your needs. Refer often to your list of priorities so you don’t miss out on something that was really important in favor of a feature that seems awesome at the time but might be unnecessary.

If you’ve decided that a single-family home is the best choice for you and your family, eliminate the other choices. If you know what you want and need, you won’t waste time looking at homes that don’t fit your criteria.

Recommended for you

3. Mortgage consultant

When buying a home, your guide for all things financial will be your mortgage consultant or mortgage loan officer. This person is a key player on your team and will start working with you in the early planning stages. Since most first-time home buyers need a loan to buy their house, there is work you can do ahead of time to make the financial piece less stressful.

An experienced mortgage broker will help you find the best loan and rates, even at times when you thought that would be difficult to accomplish. They have a full understanding of the various types of loans available, rate structure, how to qualify and how to work around any possible issues. You will check your credit report and credit score and gain tips to improve them if needed. For all of this, it’s best to start as soon as possible.

Be open and honest with this key adviser to find the best solutions for your future financial stability. Discuss your finances and any potential changes in your circumstances in the next few years. This could have a bearing on what level of commitment makes sense for you and how to avoid a possible financial burden.

When applying for financing, it’s best to maintain your status quo. Don’t quit your job, don’t make a major purchase or don’t get another credit card. Your loan officer will explain this in more detail.

7 Key Factors to Know About Living in Edina, MN

Once a farming and milling community, Edina has blossomed into a preferred suburban city with all the most desired amenities. From upscale, boutique shopping and exquisite dining to consignment shops and casual bistros, residents and visitors are enamored with the…

Getting pre-approval for a loan helps lessen the stress and removes those nagging questions from your mind, so you can focus on finding the right house in the right neighborhood. Another advantage is that, with pre-approval, your offer on a house will be more attractive to the seller than a competitive offer with no financing in place.

Your mortgage broker will help you understand what size loan you can afford (according to the lending institution), and you can decide (within those parameters) how much house you want to afford. There’s a difference. Take time to think about the mortgage payment and how it will impact other areas of your life.

You might have other expenses coming up, such as education, travel or a new child. Factor in dollars for hobbies and recreation, and save for unexpected purchases like a new appliance, replacement shingles or major auto repair.

It’s really important to carefully examine how much you can spend on a house and still live the life you want. Working with your lender will help you come up with that number—that comfortable monthly mortgage payment—knowing that it will be with you for a very long time. This is a decision that will seriously affect your finances and happiness meter. Give it plenty of thoughtful consideration.

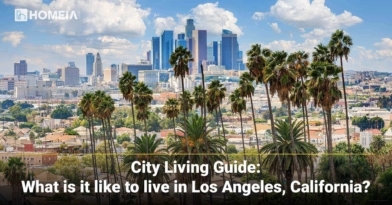

12 Key Factors to Know About Living in Los Angeles

If living in Los Angeles (or LA) is your reason for considering relocating to California, you will find a lot to love in this sunny, warm, sprawling, diverse city. In this article, we will give you a feel for L.A.’s standard of living, climate, housing, education and more. Below are top 12 key things to know about living in Los Angeles…

4. Real estate agent

Your realtor will be your advocate and help you every step of the way in this major purchase. Your job is to clearly understand and express your priorities, so that your real estate agent can guide you and help you find the best house at the best price.

Now’s the time to find that experienced local realtor and discuss your priority list, desired mortgage payment and timetable. This transaction will be one of your most important and most expensive.

It’s essential that you find a realtor who knows the industry and the local market and can work well with you as a client. If you don’t have a preferred realtor, ask for recommendations or, better yet, submit your request on HOMEiA.com and we will send you contact information and profiles for some of the best real estate agents in your area, at no charge.

The 10 Best Places in the USA to Retire on the Water for Less

The popularity of the waterfront can mean high housing costs and consumer prices. Luckily, for those willing to look past the likes of Malibu and Venice Beach, there are plenty of scenic spots along the country’s lakes and oceans where retirees can make a nice home even with a reduced…

Here are some questions you can ask the real estate agent in your interview:

- How long have you been in business in this local market?

- How do you work with clients to accommodate their schedule?

- Do you have vacations or activities planned that will interfere with our search and transaction?

- Do you have a team backing you up?

- What is your communication style?

- How many clients do you work with at one time?

- How many clients have you worked with in the last 12 months?

- Would it be okay with you if I contact a few of your recent clients for reference?

7 Key Factors You Should Know Before Living in New Prague

This city has all the advantages of small-town living with proximity to big city amenities. New Prague earned the No. 2 place on our list of the Five Best Cities for Families in Minnesota with good reason. The city is peaceful and safe with a lovely downtown, beautiful lake and opportunity…

When you interview an agent, you’ll know if they are more interested in talking or listening. Look for an agent who will listen to your priorities and help you get the job done. During a conversation, you can quickly tell if you will work well together. It’s a long process, and you need someone you can count on, communicate with and trust. Choose the best person for the job, not the one you’ve known longest or the one that is a friend of a distant relative.

Once you’ve made that connection, you’ll work with your realtor to check neighborhoods in your desired area. Review your financial priorities, so that you can be clear with the realtor about your price range. It’s easy to consider moving up in price when you see a home with attractive features. However, sticking to your budget commitment and your list of must-have features will eventually get you a house that works for your lifestyle and your finances.

Be realistic when you look at houses. Look for the necessary features to make sure they are what you had in mind. Assess the condition of the house and possible expenditures needed to make it a home. Imagine what it would be like to actually live there. Listen to your intuition and have a little patience. With your realtor’s help, you’ll find a perfectly wonderful neighborhood and house in your price range.

The 10 Best and Most Affordable Places in the US to Retire on Social Security

The retirement years bring more time to enjoy being at home or out in the community, and also a newfound geographical freedom. No longer tied to a workplace, retirees may decide that the time is right to go wherever their hearts lead them. Here we will explore some great…

When you find the home that meets your needs and brings a smile to your face, you will make an offer. Your realtor will help you make a fair and reasonable offer and will also handle any negotiations needed. Once the offer is approved, you’ll provide a deposit of earnest money. This amount varies per transaction and is placed in an escrow account until the deal is done.

The lender will also arrange for an appraisal of the property to make sure you’re not paying more than the actual value. The appraiser will visit the house, verify information, make comparisons with other properties and substantiate a market value.

At this point, there is a major sigh of relief because all your hard work has paid off in finding a home you would love to own. You’re almost there and have just a few more details to complete.

10 Most Affordable States to Buy a House

If you have the flexibility to move anywhere in the U.S., where could you buy the cheapest home? After examining data from Zillow and World Population Review. Here’re 10 most affordable States in the South and the Midwest to consider when buying a house…

5. Home inspector

Once you’ve made your offer, a home inspection is critical and requires much more than a quick look. This is your opportunity to find out the real facts about the house—those that will affect your satisfaction with the house and your bank account.

A professional home inspector is another key player on your team. It’s not a good idea to rely on opinions of well-meaning relatives or friends. If you don’t know a well-respected home inspector, ask for referrals or check online for favorable testimonials and reviews. It is well worth the fee to understand the condition of the home you’re buying.

A home inspector knows what to look for and will spend several hours checking out the condition of the home and taking photos. You should receive an extensive opinion in writing, highlighting important factors and possible expenditures or even problems looming on the horizon.

This lengthy document provides facts, photos and professional opinion if you need to re-negotiate. It will also serve as a future reference when considering equipment or appliance replacement or renovation projects.

Recommended for you

6. Insurance agent

Unexpected things do happen, and your insurance agent will talk with you about proper coverage for your new home. There’s more to it than with renter’s insurance, and a knowledgeable insurance agent will look out for your best interests. You are making a substantial investment in this property and need the proper protection for you and your family.

As with other agents, you can ask friends and colleagues for a good referral and check online for reviews. Your agent should understand the potential natural risks in your area and proper coverage for your home and belongings.

If you are buying a condo or townhome, there are special considerations to be certain you are covered appropriately for the association insurance deductibles. For this, be sure to choose an agent who is educated and experienced in policies for associations.

The agent will ask a lot of questions about the house and your possessions to make sure you are covered sufficiently in case of a loss. It’s advantageous to meet personally with the agent, so you know exactly who you are working with and how to reach them. A good business relationship is much more reassuring than only a 1-800 number.

7. Title company

Sealing the deal on a new house can induce that enthusiastic feeling of anticipation and adventure. You’ve thought it all through, made a great choice, received financing, had the home inspected and now your realtor and closer will guide you through the final details.

By this time, the seller has cleaned and vacated the property, and you have walked through the house to make a visual inspection confirming that it is in the expected condition and all agreed-upon components are still at the house.

The mysterious “closing” that people refer to is the meeting of all parties to close the deal. This usually occurs at the title company’s office. The title company has researched the title to make sure you will have clear title to the property. This means that no other person or organization has a lien or claim against it.

The closer explains all the closing costs and manages the documentation, signatures and payment process. Be prepared to sign a lot of papers! If you don’t know a closer, you can ask for recommendations from your realtor or mortgage broker. Or, look online for good reviews and rankings. Once all documents are signed and payment is processed, the seller turns over keys to the new owner—you—and the celebration begins!

Recommended for you

8. Celebrate

Now that you’re in your new home and it’s properly insured, say thank you to all those who helped you along the way. Maybe you’ll even give them glowing recommendations on their websites, Google Reviews or HOMEiA.com. They’ll appreciate it! And, as you would for any joyous occasion, enjoy it to the fullest and take lots of photos for lifelong memories!

If you enjoyed this article and are ready to embark on your house-hunting journey, please share it with a friend who might also have interest. Thank you!

Gloria Russell is the lead writer at Russell Resources LLC, a Minnesota-based company, serving clients across the country with business writing that sends a relevant message to a preferred audience. Her mission is to help businesses succeed and grow by creating original, written content for websites and articles and by editing and upgrading existing content. Having considerable experience in buying, selling and renovating homes as well as serving on association boards and managing complex projects, Gloria crafts insightful articles on current real estate topics. For more information, contact Gloria at [email protected] or 651-485-8826. Thank you!